Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

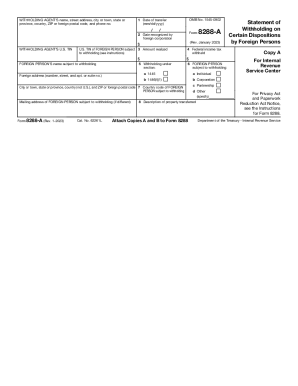

What is who files irs form?

Form 1040 is an IRS form used by individuals to file their annual income tax returns. The form is also known as the U.S. Individual Income Tax Return.

How to fill out who files irs form?

The IRS Form Who Files? is used to determine which form an individual or business must use to file their taxes. To fill out this form, you will need to provide information about your filing status, income, and any other deductions or credits you may be eligible for. Once you have completed all the required fields, you can submit the form directly to the IRS.

What is the purpose of who files irs form?

The purpose of filing IRS Form is to report your income and taxes to the Internal Revenue Service (IRS). This form is also used to claim deductions and credits, calculate taxes owed or refund due, and report other information related to your taxes.

When is the deadline to file who files irs form in 2023?

The deadline to file IRS form in 2023 is April 15, 2023.

What is the penalty for the late filing of who files irs form?

The penalty for the late filing of IRS Form 990 is up to $20,000. Penalties can be waived if the IRS determines that the organization acted in good faith and the failure was due to reasonable cause.

Who is required to file who files irs form?

Different individuals and entities are required to file IRS forms based on specific circumstances. Here are a few examples:

1. Individual taxpayers: Required to file IRS Form 1040 or one of its variations (such as 1040-A or 1040-EZ) if their income reaches certain thresholds or they meet other filing requirements.

2. Business owners: Required to file various forms depending on the type of business structure. For example, a sole proprietor may file Schedule C along with their Form 1040, while corporations may need to file Form 1120.

3. Self-employed individuals: Required to file an annual tax return using Schedule C and Schedule SE to report business income and calculate self-employment taxes.

4. Partnerships: Required to file Form 1065 to report income, deductions, gains, losses, and other relevant information for partnership tax purposes.

5. S Corporations: Required to file Form 1120-S to report their income, deductions, gains, losses, and other essential information.

6. Nonprofit organizations: Required to file Form 990 to report financial information and activities, as well as maintain their tax-exempt status.

It is important to note that these are only a few examples, and the specific forms required depend on the unique circumstances of each taxpayer or entity. It is advisable to consult with a tax professional or refer to the IRS website for detailed guidance.

What information must be reported on who files irs form?

The specific information that must be reported on IRS forms varies depending on the form being filed. However, some common information that is typically required to be reported on various IRS forms include:

1. Personal information: This includes the taxpayer's name, Social Security number or taxpayer identification number, address, and other relevant contact information.

2. Income information: All sources of income must be reported, including wages, salaries, tips, self-employment income, investment income, rental income, and any other income received during the tax year.

3. Deductions and credits: Taxpayers must report any eligible deductions and credits they claim to reduce their taxable income or to qualify for certain tax breaks. This includes deductions for expenses such as mortgage interest, medical expenses, student loan interest, and contributions to retirement accounts. It also includes tax credits for dependents, education, child or dependent care expenses, energy-efficient home improvements, and more.

4. Financial account information: In certain cases, taxpayers must provide information about foreign bank accounts and assets. This is typically reported on Form 8938 or the Report of Foreign Bank and Financial Accounts (FBAR).

5. Health insurance coverage: If applicable, individuals must report information regarding their health insurance coverage, whether obtained through an employer, government program, or individual market. This is typically reported on Form 1095-A, 1095-B, or 1095-C.

6. Business and self-employment details: If a taxpayer operates a business or is self-employed, they must report additional information, such as business income and expenses, details of any employees, and information on assets and depreciation.

It's important to note that there are numerous IRS forms available, and the information required may differ between forms and individuals' specific circumstances. Taxpayers should carefully review the instructions provided with each specific form to understand the required information.

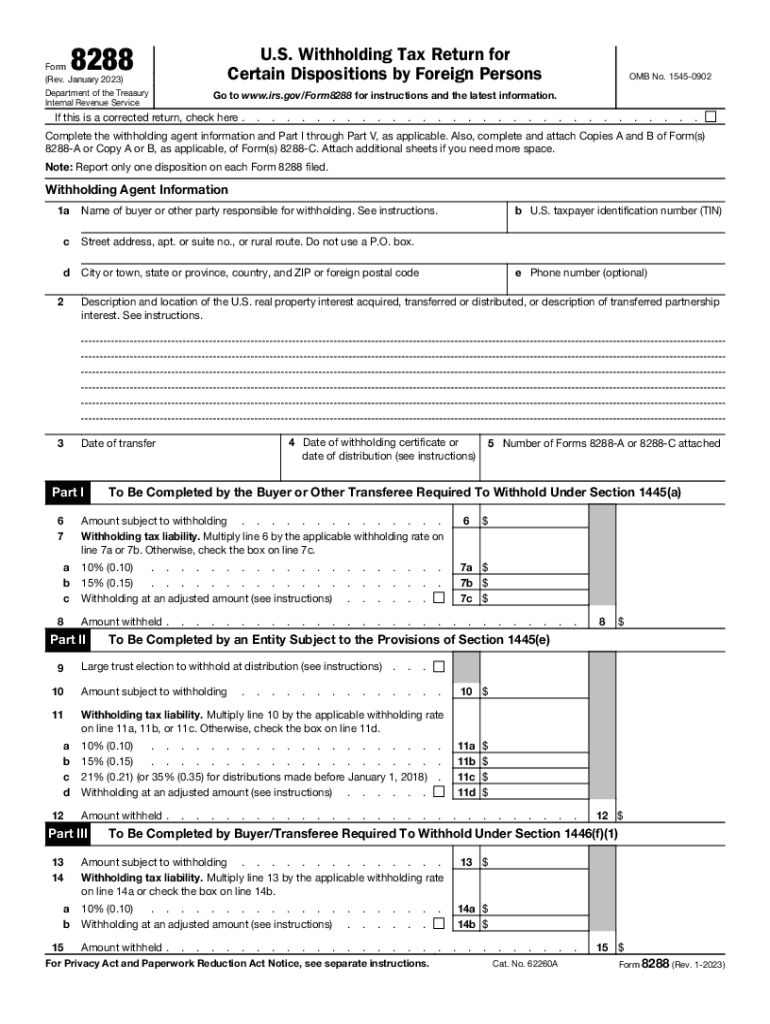

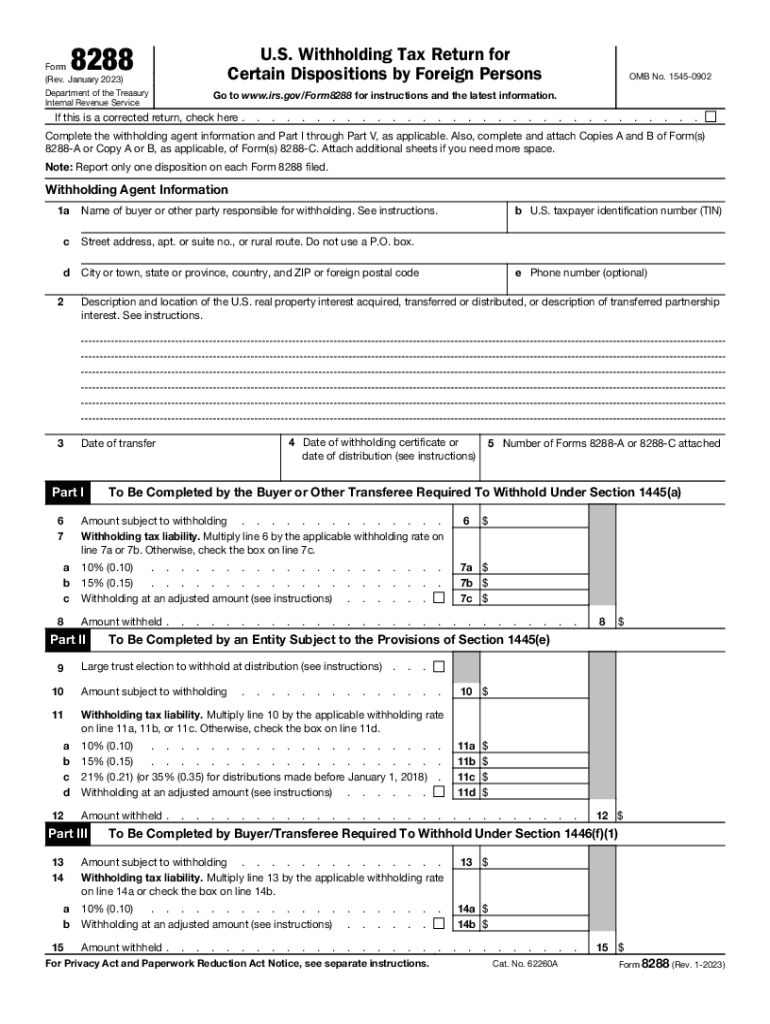

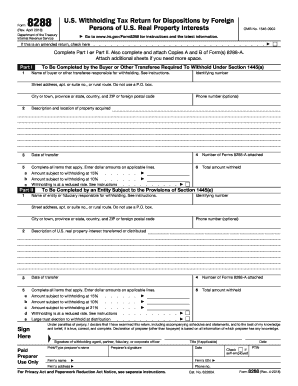

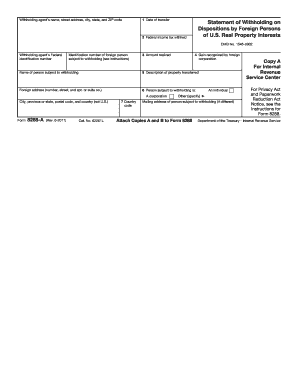

How do I edit form 8288 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing irs form 8288 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete 8288 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your irs firpta form 8288. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit 8288 form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share form 8288 instructions on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!